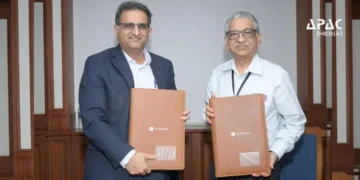

Hyderabad: Citizens Financial Group, a leading financial institution listed on the New York Stock Exchange, has announced the launch of its first Global Capability Centre (GCC) in Hyderabad. The centre is being established in collaboration with Cognizant and is aimed at enhancing the bank’s technology capabilities across enterprise platforms, customer experience, and data-driven innovation.

Scaling Digital Transformation and Innovation

The Hyderabad GCC is envisioned as a next-generation innovation hub that will play a key role in Citizens Financial Group’s technology modernisation journey. With a projected headcount of 1,000 IT and data & analytics professionals by March 2026, the centre is expected to accelerate the company’s digital transformation, improve operational efficiency, and reduce reliance on external vendor partners.

Hyderabad’s Strategic Role in Global Financial Services

The launch event in Hyderabad was attended by Duddilla Sridhar Babu, Telangana’s Minister for IT, Electronics, Industries, Commerce, and Legislative Affairs. He highlighted the city’s emergence as a top global destination for GCCs, particularly in the banking, financial services, and insurance (BFSI) sectors.

The minister pointed out that Hyderabad currently hosts more than 350 GCCs and added that in 2024 alone, the city attracted almost one new GCC every week. He also emphasized the city’s growing infrastructure and commercial ecosystem, noting that Rajiv Gandhi International Airport registered the highest passenger growth among Indian metros in 2024, commercial office space absorption grew by 56%, and 1.8 million sq ft of retail space was leased last year.

Cognizant’s Continued BFSI Commitment

Cognizant, Citizens’ strategic technology partner, will play a critical role in setting up and scaling the Hyderabad GCC. Nageswar Cherukupalli, Senior Vice-President and Business Unit Head (BFSI) at Cognizant, acknowledged Hyderabad’s growing prominence in the BFSI sector, which already houses the GCCs of Goldman Sachs, Citi Group, JPMorgan Chase, Bank of America, and Wells Fargo.

Discussion about this post