New Delhi: In a major financial reform, the Delhi Government signed a Memorandum of Understanding (MoU) with the Reserve Bank of India to strengthen fiscal management and support infrastructure-led development.

Under the agreement, the RBI will function as the banker, debt manager, and financial agent of the Delhi government. This will allow the government to raise funds through State Development Loans, manage cash professionally, and access low-cost liquidity facilities within the framework of the RBI Act and Government of India guidelines.

Focus on Infrastructure and Yamuna Rejuvenation

Delhi Chief Minister Rekha Gupta said all funds raised through market borrowings will be used only for capital expenditure. Priority sectors include Yamuna rejuvenation, drinking water supply, health infrastructure, public transport, roads, and flyovers. She underlined that the reform will ensure better use of public funds while supporting long-term development needs of the city.

Lower Borrowing Costs and Better Cash Management

The MoU will enable automatic daily investment of surplus government funds through RBI systems. It will also provide access to Ways and Means Advances and Special Drawing Facilities to manage temporary cash flow mismatches. Market borrowings will now be raised at competitive interest rates of around seven percent through State Development Loans, replacing earlier borrowings that cost 12 to 13 percent. This is expected to significantly reduce interest burden and improve financial efficiency.

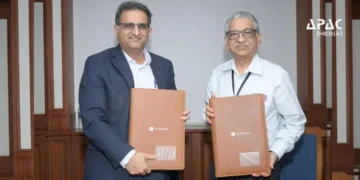

The MoU was signed at a meeting held at the Delhi Secretariat, chaired by Chief Minister Rekha Gupta, who also holds the finance portfolio. Senior officials from the Delhi government and the RBI attended the meeting, including Additional Chief Secretary (Finance) Bipul Pathak and Chief Secretary Rajiv Verma.

A Transformational Milestone

Calling the agreement a transformational milestone, Gupta said it marks a clear shift from past practices and ushers Delhi into a new phase of fiscal discipline, transparency, and institutional strength. With this step, Delhi will be fully integrated into the RBI banking system, benefiting from professional debt and cash management.

Discussion about this post