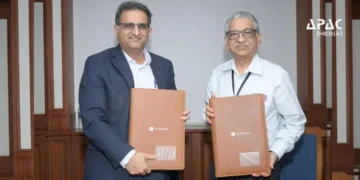

Chennai: Tamilnad Mercantile Bank (TMB), a leading private sector bank, has entered into a strategic partnership with TechFini, a UPI infrastructure and fintech solutions provider, to enhance its UPI acquiring and issuing capabilities.

Under the agreement, TechFini will act as a Technology Service Provider for the bank, supporting the expansion of TMB’s digital payments ecosystem.

The collaboration aims to deliver a faster, secure, and highly scalable UPI framework for payment aggregators, NBFCs, merchants, and fintech partners across India. Through this partnership, TMB will enable enterprises and regulated entities to build and scale high-volume digital payment and collection solutions using a bank-anchored UPI infrastructure.

Expanding UPI Use Cases in Lending and Collections

Beyond merchant payments, the partnership focuses on strengthening UPI-based lending and collections. By leveraging TechFini’s UPI Autopay solution, NBFCs and digital lenders working with TMB can automate EMI and loan repayments through e-mandates linked to customers’ UPI handles. This approach reduces dependence on cash and traditional collection systems while improving efficiency and repayment predictability.

Enterprise-Grade Technology Platform

TechFini’s cloud-native UPI platform includes TPAP, UPI Plugin SDK, acquiring and issuing infrastructure, and UPI Autopay capabilities. Designed to handle up to 10,000 transactions per second, the platform offers enterprise-level scalability, resilience, and readiness for future UPI innovations.

Building a Trusted Full-Stack UPI Ecosystem

Together, TMB and TechFini are developing a full-stack, bank-anchored UPI infrastructure that combines regulatory trust with cloud-native scalability and advanced security. The partnership is expected to support seamless digital payments and credit collections for merchants, lenders, and fintechs across the country.

Discussion about this post